In the movie “Scent of a Woman,” Al Pacino’s character Frank Slade says what makes the tango so great is that “If you make a mistake, get tangled up, just tango on.” It has felt kind of like that when it comes to global tariff negotiations.

For the first half of 2025 and beyond, tariffs have been a significant focal point of the supply chain. From a flurry of announcements, postponements, cancellations, effective dates, and tariff injunctions to what products or sectors will or will not be tariffed, it has been dizzying to keep track of shifting trade policies. While the Trump administration continues to tango with countries across the world, including the U.S.’s top three trade partners of Mexico, Canada and China, companies have been forced to react, frontloading product and then pausing around shifting deadlines, resulting in fluctuating cargo totals.

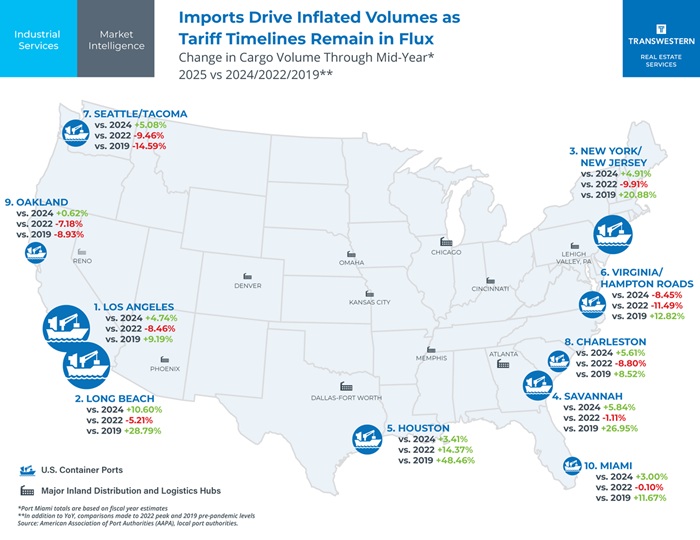

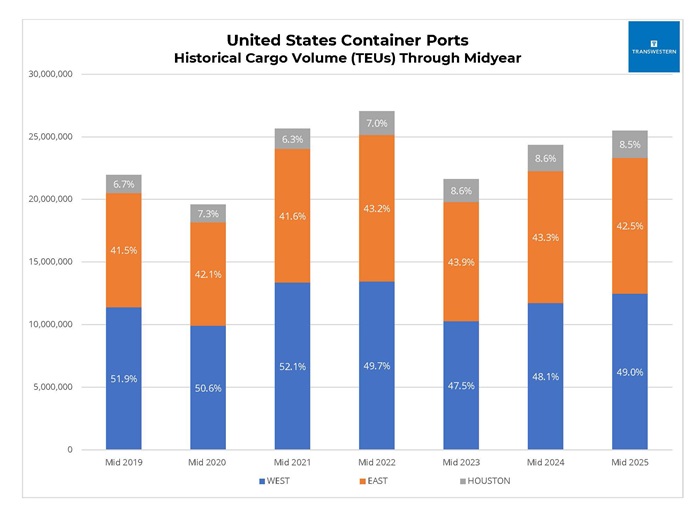

The rush to import goods ahead of tariffs has caused inflated cargo volumes, though not quite to the levels of 2021 and 2022 (with the exception of Port Houston), which represented the peak of U.S. shipping volumes when the strategy moved from just-in-time to just-in-case following the acceleration of online shopping during the pandemic. However, totals thus far this year are outpacing strong 2024 levels, as nine of the top 10 ports have processed more cargo through June when compared year-over-year. While online shopping has leveled off since the pandemic boom, cargo volumes remain well above pre-pandemic levels, with 60% of the top ports experiencing double-digit percentage increases since 2019.

Port Highlights – comparisons YoY vs. 2022 peak, and vs. 2019 pre-pandemic

(Ports listed by total cargo volume through midyear 2025)

- Port of Los Angeles recorded 4.7% growth during the first half of 2025, closing mid-year with its busiest June in history. Totals also outperformed 2019 pre-pandemic levels by 9.2% but were 8.5% lower than 2022 peak levels.

- After kicking off the year with strong totals, including a record-setting April, overall cargo volume cooled at The Port of Long Beach during May and June.Nevertheless, the totals for the first six months were 10.6% higher when compared to YoY, the highest gain among the major U.S. shipping ports. While remaining 5.2% below peak, Port of Long Beach’s cargo volume was 28.8% above pre-pandemic levels, by far the best on the West Coast.

- The Port of New York and New Jersey was the second busiest facility in the U.S. in June and processed a total of 4.4 million TEUs during the first half of 2025, 4.9% more than during the same period in 2024, and second only to its peak level of 4.9 million TEUs in 2022. The largest East Coast port has seen overall shipping volume increase by 20.9% since 2019.

- Port of Savannah recorded the highest level of growth among East Coast ports when compared to the first six months of 2024 and pre-pandemic levels. Total volume increased by 5.8%, benefiting from shifting trade patterns, and was 27.0% more than in 2019. Savannah’s overall cargo volume as of mid-year nearly matched the 2020 peak totals.

- Since 2019, Port Houston’s cargo volume has increased 48.5%, incomparable when compared to the other major U.S. ports. Thus far in 2025, 2.2 million TEUs have been processed, 3.4% more than a year ago. The largest shipping port along the Gulf Coast has experienced cargo increases through the first six months of the year in four of the past five years and is the only port through mid-2025 to exceed the 2022 U.S. peak level, doing so by a whopping 14.4%.

- The only port to experience a drop in overall cargo for mid-2025 compared to 2024 was the Port of Virginia. While falling by 8.5% YoY, it should be noted that the volume for the first six months of 2024 was inflated due to cargo being diverted from the Port of Baltimore following the collapse of the Francis Scott Key Bridge. Container volumes at the Port of Virginia remain 12.8% higher than pre-pandemic totals.

- The Ports of Seattle and Tacoma recorded solid gains during the first six months of 2025, with a 5.1% increase in cargo YoY. While a considerable improvement, the mid-2025 total is only one of two among the top 10 U.S. ports that remain below pre-pandemic levels, as, unlike most other ports, the Northwest Seaport Alliance achieved its peak level in 2018, with 2019 being its second-highest level.

- Cargo volume rebounded at Port Charleston during the first half of 2025, recording 5.6% growth when compared to YoY, second only to Savannah among East Coast Ports. Though 8.8% off its 2022 peak level, the South Carolina port processed midyear totals at a level 8.5% higher than 2019.

- With a decline in volume in June, Port of Oakland registered a nominal increase in cargo YoY, handling 0.6% more containers when compared to the first six months of 2024. The Port of Oakland, which has nearly half of its imports coming from China, joins the Ports of Seattle and Tacoma with total cargo volume remaining below pre-pandemic levels.

- Projected fiscal year totals for Port of Miami indicate 3.0% cargo volume growth for 2025, which would result in an increase of 11.7% when compared to 2019 and be only slightly off peak 2022 levels. As a gateway for trade with Latin America, South Florida ports anticipate accelerated cargo traffic resulting from nearshoring.

For the second consecutive year, the West Coast increased its market share during the first six months. At the start of 2025, the product continued to be rerouted from the East and Gulf Coasts due to the International Longshoremen's Association strike that began in October 2024 – a new contract wasn’t finalized until March 2025. At the same time, goods were imported, most notably from China, ahead of potential tariffs while trade policy negotiations continued. Port Long Beach benefited most, recording a 10.6% jump in overall volume. While the East Coast share of cargo was down, the Gulf Coast Port of Houston maintained its portion, driven by a continuing booming economy in the region and bolstered by the Houston Ship Channel expansion project.

A serious slowdown in imports is anticipated for the final months of the year, and possibly beyond. Retail sales remain strong, up nearly 5.0% YoY. However, when adjusting for inflation to better reflect consumer demand and the actual amount of goods being sold, real retail sales, though still up 2.0%, are increasing at a slower pace than historical averages, a trend that is anticipated to continue. While still resilient, consumer spending is expected to decrease as sentiment has dropped considerably, and many are facing rising credit card debts and the return of student loan payments, though lower interest rates would provide some comfort. While tariff effects on inflation may have been wildly overestimated, they still stand to impact the consumer, though probably only in the short term. Onshoring will also decrease cargo volume, considerably in the long term.

For now, retailers are continuing to frontload during the summer months, doing their holiday ordering earlier than usual, taking advantage while they can, while being careful not to overstock and potentially lease warehouse space they will only need short-term, which was a common occurrence during the pandemic. Though lower courts question their legality, tariffs will stay in place until October 14 allowing for appeals and the Supreme Court will hear the case in early November 2025. In the meantime, trade talks continue, and uncertainty prevails. When the uncertainty will end is anyone’s guess, but one thing is for certain: it takes two to tango. Hoo-ah!

SEE ALSO:

- US Industrial Market Overview - Transwestern

- TW National Industrial Report: Elite Market

- Eye of the Industrial Market Storm

- Picture the Possibilities: Simplifying Data Analysis with GIS

- Stocked Retailer Inventories Result in First Cargo Volume Decrease Since 2020

RELATED TOPICS:

commercial real estate

industrial real estate

market reports

tenant advisory

capital markets